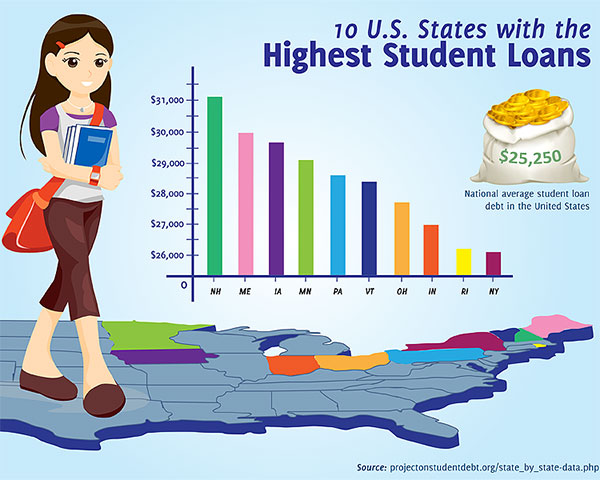

10 U.S. States With the Highest Student Loan Debt

July 18, 2012

The nationwide average for student loan debt is at a

whopping $25,250, with collective student debt in the U.S. topping $1

trillion and outstripping total credit card debt for the first time in

history. As a result, student debt has become a pivotal national issue,

with students protesting and economists warning of the impending

collapse of the higher education bubble.

Yet not all states are experiencing the debt crisis in the same way.

Some have relatively low rates of student debt, while others are

surpassing the national average by several thousand dollars. Here, we

highlight the states with the highest levels of student loan debt (with

data drawn from the 2011 Project on Student Debt),

where students face even more difficulty than other places in the

nation paying back the high cost of their college education.-

New Hampshire:

Students in New Hampshire face average student loan debt that is higher than anywhere in the nation, coming in at $31,048. That’s almost $6,000 more than the national average. Even worse, New Hampshire also has the second-greatest proportion of students with debt, a staggering 74%. The high ranking of the state wasn’t especially surprising, as funding for public higher education declined by 48% between 2011 and 2012, far outpacing the national average of 6.1%. A number of New Hampshire colleges also rank among those with the highest debt in the nation, including the University of New Hampshire with an average of $32,320 in debt and Saint Anselm College with an average of $39,000 in debt. Surprisingly, more expensive and prestigious schools in the state carry much lower levels of debt, due largely to their sizable endowments and wealthy students, as those studying at the well-ranked Dartmouth graduated with just $18,700 in debt.

-

Maine:

Maine isn’t far behind New Hampshire, with student debt that averages out at $29,983, with 68% of the state’s college graduates carrying loans. The debt has caused many students and members of the community to take to the streets in protest, but it isn’t likely to change anytime soon. The state is home to a number of the nation’s highest debt public universities, including the Maine Maritime Academy and the University of Southern Maine. Legislators in the state aren’t ignoring the issue, however, and Democratic Representative Mike Michaud has proposed the Student Loan Default Prevention Act, which would allow the Finance Authority of Maine to provide financial guidance and advice on managing their debt.

-

Iowa:

Surprisingly, this Midwestern state is home to some of the highest student debt in the nation, with the average student carrying $29,598 in student loans. The state has hovered near the top of the rankings for a couple of years, dropping from second to fourth, before surging back up to third in the latest rankings. Statewide, 72% of Iowa’s students graduate with student loan debt and one of its largest schools, Iowa State University, ranks among the highest debt public colleges and universities in the nation. Student debt is even worse at the University of Dubuque, where students graduate with debt that averages $41,399 and even the prestigious University of Iowa leaves students with debt well over the national average, costing a hefty $27,391.

-

Minnesota:

According to data from the Project on Student debt, the average student in Minnesota is trying to pay back $29,058 for college education after graduation. Debt levels for Minnesota students have increased rapidly over the past decade, with the average debt for students at the University of Minnesota jumping from $18,000 in 2005 to $27,000 in 2011. Despite the high rate of debt of students in Minnesota (the state is home to three of the nation’s most high-debt colleges), some legislators in the state have been fighting against President Obama’s initiative to cap student loan interest, something the majority of students simply can’t afford to carry in addition to already sky-high debt.

-

Pennsylvania:

Students in Pennsylvania have it rough when it comes to student debt, carrying an average of $28,599. Much of this comes from Pennsylvania State and Temple University’s incredibly high rates of student debt, averaging $31,135 and $31,123 respectively. Non-profits like St. Joseph’s College and Widener University aren’t helping matters, weighing students down with $44,336 in debt and $40,386 at each institution. These schools are just a handful of the high debt schools in the state. Pennsylvania is home to 22 of the 30 most expensive state schools in the U.S. and a number of other private schools that boast some of the highest tuition in the nation.

-

Vermont:

Vermont is another East Coast state being crippled by high student debt. Students in this state carry an average of $28,391 in debt, and more than 70% leave school with some level of student loan debt. The reason? Vermont has the highest cost in the nation for public two-year and four-year colleges, with rates that continue to rise by as much as 8% each year. The average price of just tuition at a Vermont public university is $11,341, much higher than the national average of $6,585. Two-year colleges aren’t much better, charging a hefty $5,830. With such expensive schools in the state, it’s no wonder so many students are left burdened with large amounts of debt after graduation.

-

Ohio:

Ohio’s average student debt is enough to make you cringe ($27,713), but the state is also home to three of the nation’s most high-debt colleges: Cleveland Institute of Art, Ohio Northern University, and Bowling Green State University. As a result, more than 68% of Ohio students graduate in debt, with numbers that put them among the top 10 most indebted in the nation. Politicians in Ohio have taken note of the issue and are working to help lessen the financial burden many students face. Plans are in the works to reduce the amount of time it takes to get some degrees from four years to three and to allow more transfer credits from work experience.

-

Indiana:

The cost of living in Indiana is relatively low, but the cost of college isn’t: most students owe at least $27,000 in college loans after graduation and 62% hold some level of debt, whether above or below this figure. Indiana University has the highest average student debt of any higher educational facility in the state, with students owing an average of $28,000, though Purdue and Ball State aren’t far behind with averages of $26,000 and $24,000 respectively. Schools are trying to cut costs for students, however. IU has increased gift aid by 77% since 2005 and IU-Bloomington has introduced flat-rate tuition. Still, students in the state are taking a heavy hit financially, and it may take more than a few breaks to help them seriously cut college costs.

-

Rhode Island:

Rhode Island may be America’s smallest state, but the debt of its college students is surprisingly large. The average college graduate in Rhode Island is saddled with $26,340 worth of debt for college, a rate just higher than that of nearby New York and more than even big Ivy League states like Massachusetts and Connecticut. Pushing up the average in the state are private schools like Bryant University ($39,490 in average debt), Salve Regina ($35,737), and Providence College ($32,850). Sadly, many students may take on more debt than they can handle, with GoLocalProv reporting that more than 4,000 Rhode Island grads have defaulted on their loans since 2007.

-

New York:

New York City may be one of the most expensive cities in the world, but students in New York slide in at number 10 in terms of student debt, with the average holding steady at $26,271. That’s still a pretty big chunk of change and well above the national average, but not as high as it could be and considerably less than many other New England states. As of 2012, the collective student loan debt of students in New York totaled $66.8 billion, representing 9.3% of total consumer debt in the state. Many are defaulting as well (7.1% in 2009), but there is help available for some students. Niagara Falls, N.Y. is offering $7,000 toward student debt to young professionals who move to their town in an effort to revive the city, which has in recent years lost more than half its population. Legislators in the state have also largely been on the side of students, working hard to ensure that interest rates stay low and that students can afford to attend college.

No comments:

Post a Comment